The Statement of Activities is the Income Statement of a nonprofit organization. It’s one of the core financial statements that all nonprofits need.

You may also hear it referred to as a profit and loss statement or income and expense report.

Simply, it reports your organization’s revenue and expenses during a specific period and the difference between them.

In the for-profit world, they call the difference between revenues and expenses net income (or profit).

But a nonprofit calls the difference between revenue and expenses change in net assets .

Like all nonprofit financial statements , the central role of the Statement of Activities is to provide transparency and accountability to your donors and board. But it’s also an excellent tool for understanding just how healthy your business is.

The Statement of Activities contains 3 main sections:

By starting with your revenues and subtracting your expenses, the report helps you answer the all-important question:

Did we bring in more money than we spent?

The Statement of Activities further breaks down your revenue and expenses according to any restrictions limiting how or when you may use them.

Revenue includes all flows of cash into your business. It includes donations, grants, fundraising, earned revenue, government funding, and special events.

NOTE: For a nonprofit organization, revenue also includes non-cash gifts, like in-kind donations of goods or services.

If you use cash-based accounting, you’ll only record cash deposited into your bank during the reporting period.

But, since auditable nonprofit financial statements, we’ll talk about accrual accounting practices in this article. That means your revenue will also include any donations pledged in the period (whether you collected the cash or not) and any receivables (for services rendered but not yet paid).

To comply with Generally Accepted Accounting Principles (GAAP), you must separate your revenue into at least 2 categories:

Restricted Revenue shows funds with donor-placed restrictions on how or when you can spend the money. You can include all restricted funds together or segment them by donation type.

Unrestricted Revenue shows funds without donor-placed restrictions. You can use unrestricted funds for any mission-oriented purpose , including paying general operating expenses and salaries.

You may choose to break down your revenue into additional categories, such as:

Sources of Unrestricted Donations: Individuals versus organizations or foundations.

Federated Campaigns: Donations received indirectly from the public by a fundraising group, like United Way..

Government Funding: Funds from local, state, or federal government organizations

Earned Revenue: Income from the sale of goods, services rendered, or work performed

Special Events: Revenue earned at fundraising events (You’re required to keep track of each event separately once it hits $5,000 in revenue.)

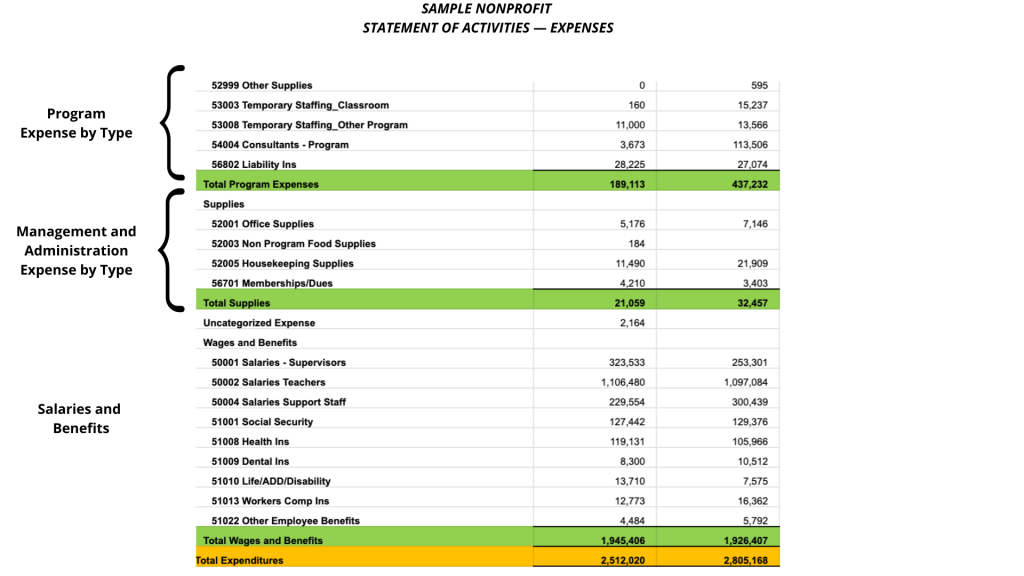

The expense section reports all cash that flows out of your organization, including pending expenses—those you know you’ve incurred but haven’t spent the money yet, such as payroll for hours worked the previous month.

NOTE: Nonprofit expenses include any outflow of assets, like in-kind donations and depreciation expenses (not only cash).

Since functional expenses are a big theme for many investors, particularly the percentage of money you’re spending on programs, most nonprofit Statement of Activities are organized according to functional expenses .

Expenses are shown by all significant or relevant categories. These are the most common:

Programs: expenses incurred while carrying out your mission through goods and services

Management and Administration: typically includes “overhead costs,” including operational expenses that don’t specifically relate to executing your mission or fundraising.

Fundraising: costs directly tied to raising money, including special event costs, advertising, and fundraising staff salaries.

The Change in Net Assets is your bottom line– did you bring in more money than you gave out?

It shows you the “profit” of your nonprofit. But here, we call profit a “surplus” instead.

Yes, a nonprofit can make money. While the goal of a nonprofit isn’t to turn a profit, if you don’t bring in more than you spend, you won’t be able to survive. And a little “profit” helps build your operating reserves to help you survive a slow-fundraising quarter or unexpected expenses.

The Change in Net Assets section shows you how much money you made with a simple equation:

Net Revenue – Net Expenses = Change in Net Assets

Once you have the change in net assets, you can compare revenue and expenses by significant program activity (or function) to see exactly where you are making or losing money.

You should look at your Statement of Activities every month and compare to previous periods. Identify trends and changes in sources of revenue, expenses, and changes to net assets.

Almost all nonprofits will have deficits in specific periods. But those should be offset by surpluses in other periods.

But if you’re spending more than you bring in for several periods in a row, you’re headed for trouble. So you need to figure out what’s going on and fix it. Before you end up out of business.

Your nonprofit Income Statement shows the year-over-year income and spending trends. And how those expenses relate to the work of carrying out your mission.

But, it also answers several questions about your organization’s overall financial health.

Here are just a few of the questions your CPA or auditor will be asking when reviewing your Statement of Activities:

Questions about Revenue

Questions about Expenses

A balance sheet is a term commonly known in profit businesses. In the nonprofit sector, there is a similar report known as a “Statement of Financial Position,” “Statement of Activities,” or a “Statement of Cash Flows.”

This type of report gives a quick look at the financial position of an organization. While very similar to an income statement, the balance sheet shows financial activities over a shorter period of time. The information is very similar including:

At The Charity CFO, we help 150+ nonprofits get audit-ready financial reports monthly, like clockwork.

We can help you modernize and optimize your accounting systems while also taking the time-sucking bookkeeping tasks off of your hands. And be the trusted financial partner you can turn to for answers to your questions and expert financial advice.

If you’re ready for an accounting partner to ease the burden of monthly bookkeeping and accounting, reach out to us for a free consultation.

We’ll help you determine if outsourcing your accounting and bookkeeping is the right decision for your organization.

No time to read this article now? Download it for later.

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization's finances.